WTOP: 5 ways nonprofits can…

The 2025 Compensation Landscape

The Economy & Wage GrowthThere are several economic factors that affect wage growth and what employers need to be mindful of when looking at the labor market. The unemployment rate, open jobs, hires and voluntary quits are the primary elements to review when evaluating the labor market and the implication for employers. Periods of high inflation can play a minor role in wage growth; however, wage growth usually outpaces inflation, so these effects are minimal. The labor market remains tight but continues to show signs of softening as many economic factors start to stabilize and shift back toward what might be considered normal, or at least pre-pandemic levels. Wage growth has stabilized over the past year following inflation rates trending toward optimal level of 2% according to the Federal Reserve. The Paris-based Organization for Economic Cooperation and Development (OECD) (2024) updated its interim projection saying that headline inflation is expected to decline further with the U.S falling to 1.8% in 2025 where previously it was projected at 2.2%. Figure 1. Wage Growth vs. Inflation

This is good news for employees who have been feeling the strain of and stickiness of inflation since 2023 as wage growth once again outpaces inflation. The growth of real wages, i.e., inflation-adjusted wage growth, over the past two years has, in fact, accelerated at a fairly rapid rate as the labor market has remained strong alongside the persistent decline in inflation. The result has been increased buying power for workers. According to Greg Ip, senior economics commentator at the Wall Street Journal, the next administration inherits a “pretty good economy…[t]here’s really no reason to think that there’s a recession in store in the next year or two.” Still, specifics are unclear about what economic policies the next administration and congress will put in place.

Figure 2. Percent Change in Real Wages

From Council of Economic Advisors

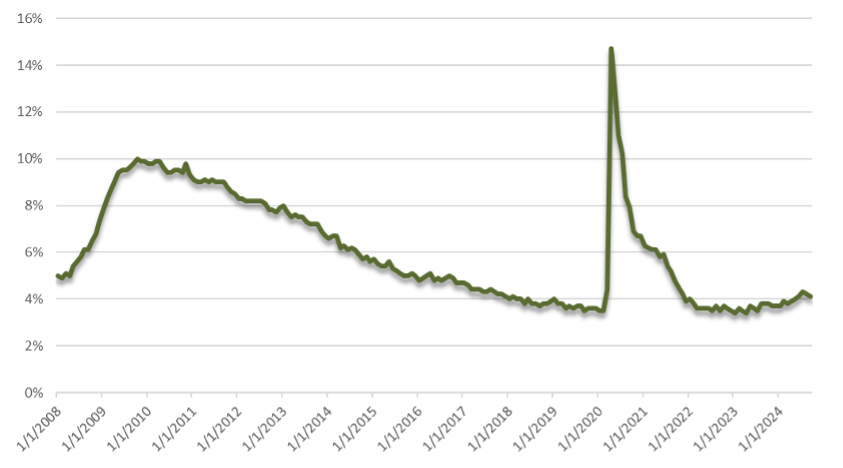

Unemployment has been trending upward from historic lows and what had been considered “full employment.” The trend upward back in July triggered the “Sahm Rule,” so named for economist Claudia Sahm, which is seen as an early indicator of a recession. But even Sahm believes that her rule was meant to be broken and that the U.S. is not in a recession. Had the U.S. been entering a recession, wage growth would stagnate or even become negative so it can be surmised that wage growth, as a factor of unemployment, will continue at or around current levels. The rise in immigration, according to Sahm, would also contribute significantly to the rise in unemployment as the overall size of the workforce increases. The Federal Reserve Bank of St. Louis and the OECD project that unemployment levels for 2025 will be at 4.4% and 4.0% respectively. While not “full employment” per se, this does mean that the availability of workers remains low, and that wage growth will likely remain elevated as employers work to compete for talent from a scarce pool, though it is certainly not the only factor in that equation.

Figure 3. Unemployment Rate

As unemployment cools, so, too, does job creation. Job reports continue to come in lower than expectations over the past year. According to Bankrate’s Q3 Economic Indicator Survey, the average forecast for jobs created for each month through September 2025 is only 104,000. This is half as many jobs as were created since October 2023. Selma Hepp, Chief Economist at Corelogic, stated, “While the labor market continues to slow, it remains solid. Slowing of job additions mostly reflects rebalancing of overheated conditions that characterized the labor market during the pandemic.”

Figure 4. Open Jobs vs. Hires

Job openings in 2025 are expected to stay in the upper 700 thousands, extending the downward trend experienced the past couple of years. The gap between job openings and hires is also narrowing which has two implications. First, employer hiring remains resilient though showing signs of slowing somewhat. Second, employer demand for labor is slowing significantly resulting in stronger competition for new positions. The large gap, overall, still means that wage growth is expected to remain elevated to be able to attract needed talent. Voluntary turnover continues its downward trend and has fallen to rates less than pre-pandemic levels. While organizations collectively experienced the Great Resignation at the height of the pandemic, the era of the Great Stay seems to have taken hold. According to a March 2024 Ringover survey, almost 80% of employees don’t plan on changing jobs until at least 2025. While the uncertainty of the economy did play a factor into the survey participants inclination to look for a new job (35.7%), better work-life balance (43.7%), company improvements (42.0%), and having only recently started a job (38.6%) played larger roles into that decision. According to Steve Nyce, economist with WTW, “[E]mployees are looking for greater certainty and security in their lives.”[1]

Figure 5. Voluntary Resignations

Overall, the labor market is still tight, and compensation levels are likely to remain elevated for the near future. The labor market cooling has not readily translated into top talent being readily available and, even then, it appears that attitudes with current employers have shifted. Additionally, the hiring frenzy over the past few years has led to more employers, and candidates, taking their time in hiring decisions with higher expectations on both sides. Employers’ ResponsesPayScale’s 2024 Compensation Best Practices Report found that 50% of participants felt that compensation continued to be more challenging than in 2023 with retention coming in at 44%. About a third of participants labeled these two areas as higher priority investment areas. Nonprofit voluntary turnover was reported at 19%, down 5% from the year before. Actual salary expense increases in 2024 continued to see a downward trend from previous years. According to PayScale’s 2024-2025 Salary Budget Survey, actual total salary increases across all employee groups for nonprofit organizations averaged approximately 3.4%. World at Work’s 2024-2025 Salary Budget Survey found that the average increase across all employee groups in the U.S. was 3.9%. Mercer also reported total actual increases for 2024 at 3.6%. These figures are slightly lower than what had originally been projected in late 2023. Nonprofit HR’s own Total Rewards Practices Survey (2024) found that nonprofit organizations are mostly aligned with these figures as they offer competitive 3%-5% annual increase to salaries. While these actuals are higher than pre-pandemic levels and above inflation rates, increases continue to trend downward. PayScale, World at Work and Mercer report that 2025 projections are 3.4%, 3.8% and 3.6% respectively for salary increase budgets. These figures mostly match the actuals from 2024 so most employers are still expecting to face challenges when it comes to keeping wages competitive enough for attraction and retention. Korn Ferry reports that “[a] slight majority [of organizations (61%) are not expecting to reduce their budgeted reward spend [and] 39% of companies have already reduced or plan to reduce their total rewards budget.” Other variable components to pay, including various types of one-time bonuses, are slowing down according to the Conference Board’s U.S. Salary Increase Budgets 2024-25 report. According to researchers, “[T]his indicates a balancing act between salary and wage pressures and performance-based and budget-flexible compensation strategies.” Leadership ConsiderationsEvaluate & Formalize Total Rewards StrategyThe Great Stay may require employers to rethink and/or amplify their total rewards strategy, if they haven’t done so already, as more employees are willing to stay and that it may be more difficult to attract candidates looking for everything that a total rewards strategy should offer. Nonprofit HR’s Total Rewards Practices Survey found that only 40% of participants consider compensation top of mind; for many candidates and employees they want places to work that value them as a person and offer them flexible options that integrate and accommodate their needs and wants. The Great Stay also, as previously noted, means that top talent is not readily available, so it is crucial that employers identify those things that not only are valuable to their employees but would also be desirable for candidates as well. Robust benefit offerings have long been a hallmark of a nonprofit employer’s value proposition. Healthcare costs generally continue to rise, and the richer plans combined with higher employer coverage of premium cost-shares, if not outright fully paid, are just as attractive to current and future employees. Employers who have just kept renewing the same benefit plans year after year should consider working with their broker to evaluate other inclusive options that provide more and or different choices for meaningful impact. Employers may also want to survey their current employees on benefit offerings and see what else may be of value to them in deciding what to adopt in the new plan year or at any other time if options aren’t tied to specific regulatory requirements. Professional development has always been important, but in a competitive environment it is even more so as employers strategically develop their workforce. According to a Pew Research Center Survey (2022), 63% of workers left their job in 2021 because there was no opportunity for advancement. Voluntary quits only increased in 2022 for the same reasons. Professional development opportunities come in many forms, including online learning, job shadowing, mentorship, seminars, workshops, certification courses, memberships to professional organizations and tuition support for degree programs. An employer’s investment in their employee’s professional development offers the following in return:

Revise Total Rewards BudgetThe market continues to cool but employers will still need some flexibility to address talent attraction and retention challenges. Nonprofit HR recommends planning for an increase to salary budgets of 3.4-3.6% based on current economic indicators. Pre-pandemic trends of 3% are still not sufficient in this labor market. Even so, a larger budget for salary increases alone is not enough to address attraction and retention challenges, even if most employers are expecting to reduce their budgets from what was spent in 2022 through 2024. Employers should also consider taking a closer look at their benefits and employee experience budgets as well. Not all components of total rewards will cost money. Non-monetary actions to attract and retain talent — including increasing workplace flexibility, placing a broader emphasis on diversity, equity, and inclusion efforts, and making changes to improve the overall employee experience — may be just as valued by employees and will only cost the time and effort to research the needs and put the appropriate policies and programs in place. Educate & CommunicateThe Great Stay requires more education and communication around Total Rewards to emphasize both the dollar and intangible value of everything candidates and employees can get from an employer. According to O.C. Tanner, “[L]ess than 40% of workers know the meaning of the term, “Total Rewards,” and only 14% of those people can explain it. Some confuse it with a customer loyalty program.” Korn Ferry also reports that most organizations don’t believe that their employees understand their reward strategy. Candidates and employees must believe that employers have their best interests at heart or else it won’t matter how expansive the total rewards package is. Effective communications can be achieved through:

Employers should continue to market the totality of their total rewards package, highlighting benefits as a key component. Employers should consider quantifying the cost of benefits offered as much as possible, potentially through a sample total rewards statement, to fully showcase the value. Applicants and current employees can then make more informed decisions about their options when considering their employment situation. Be TransparentPay transparency laws are on the rise with 19 states in 2025 having some sort of legislation requiring employers to publicly post pay information on job openings. According to research from the Society for Human Resource Management (SHRM) (2023), 70% of organizations that list pay ranges on job postings have seen an increase in applications for their openings and about two-thirds of participants said that listing pay ranges publicly has also led to an increase in the quality of applicants. The same SHRM survey also found that 82% of workers are more likely to consider applying to a job if the pay range was listed and 74% of workers are less interested if the pay range is not listed. This practice can be a boon to employers in a tight market and may even increase the level of trust that applicants may have toward an employer that is willing to share such information, even if not legally mandated. Employers are cautioned to address salary compression issues as part of any transparency initiatives to ensure that current employees are equitably compensated with any new hires coming in. Hire QuickerWhile there are higher expectations on both sides of the table when it comes to hiring, employers would be remiss in continuing with overly extensive recruiting processes that drag on without adding any value. The shortage of talent alongside elevated wage growth means that job seekers have more options and employers may miss out on skilled candidates. According to Robert Half, hiring managers that wait for a candidate to check every box experience higher turnover due to increased workloads for everyone else (45%), higher recruitment costs overall (42%) and loss of candidates to competitors (39%). Focus On Cost of LaborNonprofit HR continues to stress that employers focus on cost of labor and not cost of living. The cost of living is the market value of goods, such as housing, food and fuel. The cost of labor is how expensive it is to hire people in an area and not how expensive it is to live in that area. There is no correlation between the two measures. The cost of labor has historically outpaced the cost of living. Wage growth is already outpacing inflation, and, given current projections, should not be an issue within the next year. Employers who overcorrected for inflation should likely cut back on compensation increases to adjust for what actual wage growth occurred over the past couple of years. Employers that have traditionally only focused on cost-of-living increases should consider incorporating either some other element for pay increases to remain competitive or invest more heavily in other total rewards components to retain current employees. While inflation should not be an issue within the next year, the “stickiness” of the compounding effects of inflation over time may still be a challenge to real wages experienced by some employees. Real wages are and have been on the rise again so there likely isn’t a need for employers to take any additional action at this time to alleviate any pocketbook stress. Refresh Market DataWhile the labor market is cooling off, the lingering effects of the volatility over the past few years are still being felt by organizations. Nonprofit HR continues to recommend that organizations review their compensation structures, either grade or job ranges, at least every two years until such time as the labor market is a little more stable and predictable. This will help organizations account for any new trends in the labor market as it continues to settle down. Previous guidance given to clients had been to review market ranges or compensation structures at least every three years. However, employers’ responses to the pandemic and subsequent inflation have introduced more factors than were previously considered in setting pay. Organizations may be tempted to simply apply a percentage increase to their current compensation structure. However, this is not strictly recommended, since a percentage increase to the ranges of a compensation structure does not necessarily reflect the shift in the cost of labor within the market. That figure may be used as a quick way to estimate what the overall cost of labor might be in setting salary budgets. However, overall market value is more complex, and the reality is that some jobs may decrease in market value while others increase at rates that far surpass budget planning figures. Participate in Compensation SurveysFinally, Nonprofit HR always recommends that employers participate in multiple compensation surveys relevant to the nature of the mission and status as a nonprofit. While this can be a time-consuming process, particularly for the first time with a new vendor, completing this step can offer a valuable contribution to the sector. Participation in this process helps to ensure that surveys have the broadest range of data available to accurately report on the market worth of the jobs that they examine, and thus strengthens the common understanding of the market and the range of pay practices implemented by survey respondents within their respective organizations. Participation in these surveys may also help bring about more equity with compensation. While there are systemic issues with compensation data that is reported due to decades of compounding issues, the data that is provided is still the best place to start in making pay decisions that are easily defensible. That said, organizations that participate in compensation surveys and are also making more equitable pay decisions are contributing to the correction of systemic inequities in compensation data available from third party sources. This means that other organizations will also benefit from this reporting and bring more parity to the sector overall. Contributing Author Stuart Wales, MS, SHRM-CP, PHR, CCP |