WTOP: 5 ways nonprofits can…

Total

Rewards

2023-2024 COMPENSATION LANDSCAPE OUTLOOK

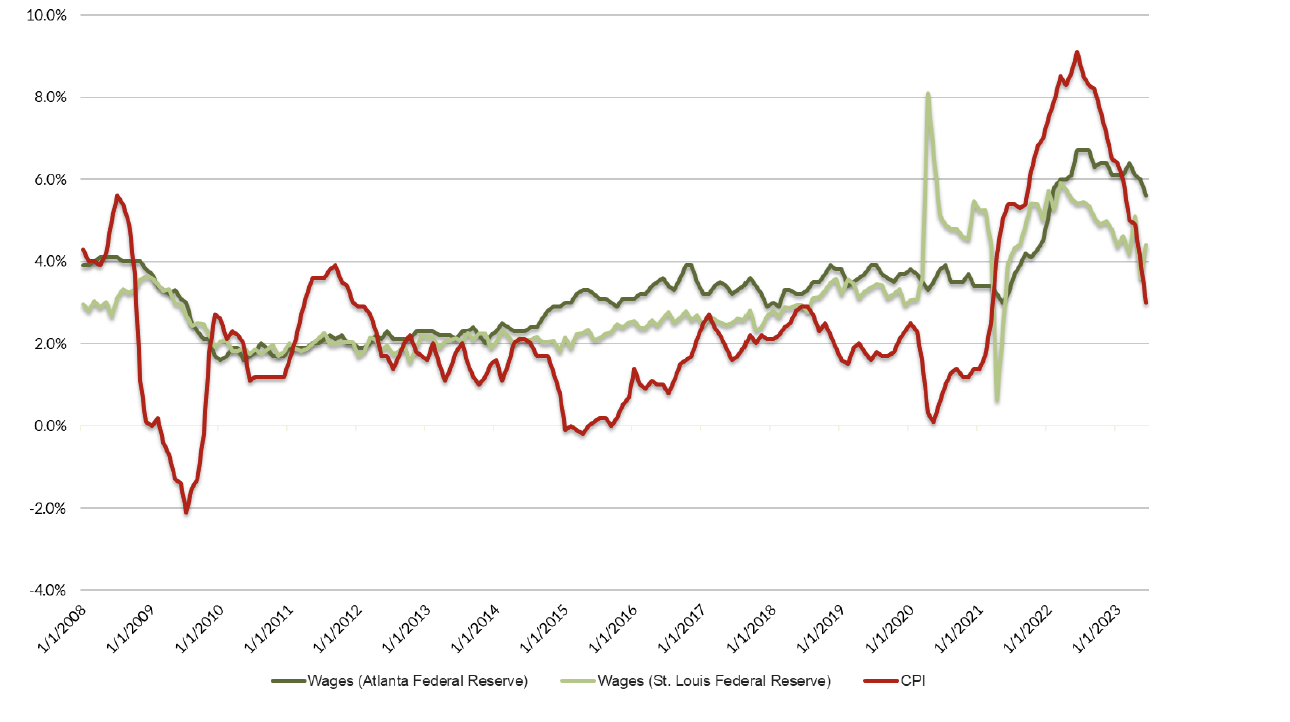

Wage growth remains at elevated levels, though it appears to have leveled off. According to the Economic Research Institute’s July 2023 National Compensation Forecast, the last four quarters saw a 4.95% increase. The previous peak was at 5.23% back in 2007. While wage growth has stabilized, various economic factors may continue to force employers to increase compensation to be able to attract and retain talent.

Annualized Change in Wages and Consumer Price Index (January 2008 to June 2023)

In other good signs for the labor market, inflation is leveling off with June 2023 coming in at just under 3%. Wage growth is now again outpacing inflation as has been the historic trend and employee purchasing power is returning to levels last seen in early 2021.

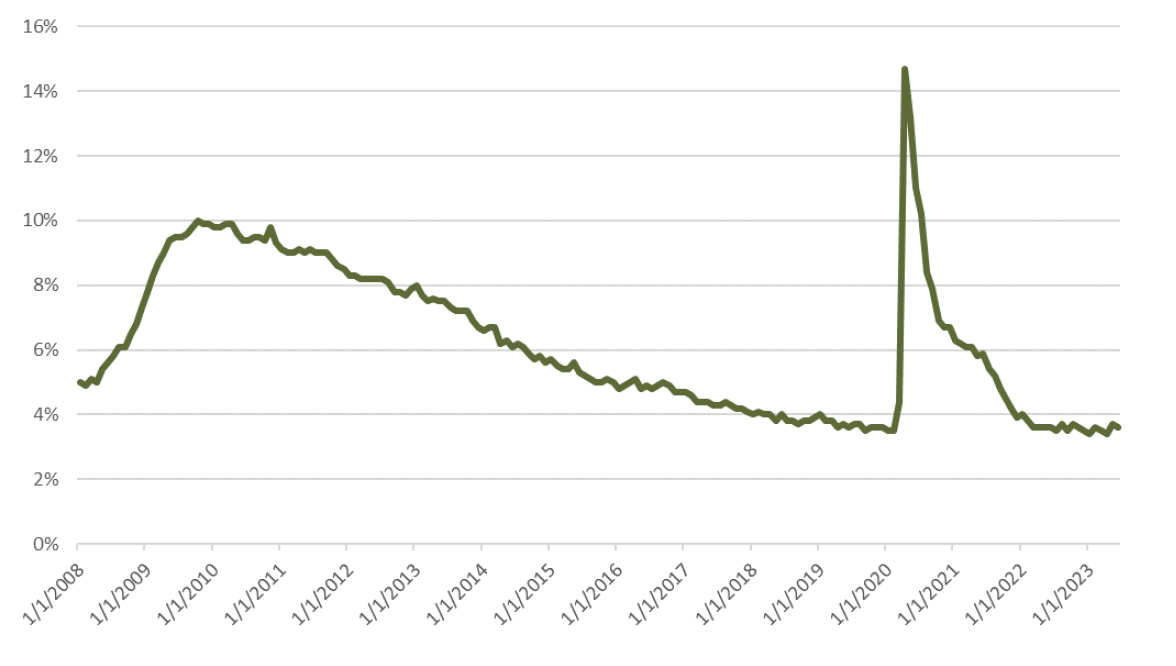

Unemployment rates continue to remain historically low, with June 2023 coming in at 3.6% matching levels from early 2020. The Federal Reserve has predicted that the unemployment rate will rise to 4.5% this year in line with an expected recession, but it still does not show signs of ticking up yet. This continues to make recruiting new talent difficult as rates this low are considered “full employment.” This, too, may have implications for increased compensation rates to hire employees.

Voluntary turnover is also trending downward. The Bureau of Labor Statistics (BLS) found that 70% of all job separations were due to quits in 2022 which is the highest annual level recorded by the Job Openings and Labor Turnover Survey (JOLTS) program. PayScale reported that voluntary turnover dropped from 36% to 25% for participating organizations in their 2023 Compensation Best Practices report. Of those organizations participating in the PayScale 2023 Compensation Best Practices report, 35% indicated that compensation is still the primary reason for higher voluntary turnover with another 18% citing it as a secondary reason. Current BLS data, too, shows that the quit rate is currently at 2.4% down from earlier in the year, but still higher than the 10-year average. This again could mean continued higher wage growth.

Unemployment Rate (January 2008 to June 2023)

The labor market continues to be competitive, though it is showing signs of slowing down. For now, employers’ ability to attract and retain talent will continue to be a challenge with full-employment levels and low unemployment rates. The job open rate is at 6.1% which is higher than the 10-year average but still down from where it was in March 2022 at 7.3%. Hiring continues to be strong, though slowing to a more sustainable pace according to the latest reports from BLS. This defies expectations of a recession some economists believe is still in store for the end of the year or early 2024.

Open Jobs vs. Hires (in thousands, January 2008 to June 2023)

These concerns over a tight labor market driven by worker shortages are prompting employers to make changes in their salary budgets. According to Willis Towers Watson’s (WTW) latest Salary Budget Planning Survey, employers are budgeting for a 4.0% increase for 2024. This is down from 2023’s actual increase of 4.4%, but it remains elevated from 2021’s 3.1% increase and for the 10 years prior to that. The survey also found that most employers (70%) are either maintaining or increasing their salary budget. Only 14% of participating organizations have reduced their budgets, in response to concerns over a possible recession.

PayScale’s 2023 Compensation Best Practices Report found that 60% of organizations felt that labor challenges were greater in 2022 than in previous years with the same challenges continuing in 2023. WTW reported that more than half of participating organizations faced challenges with attraction or retention, which is down from 51% the previous year. The same report also found that organizations are expecting labor market pressures to ease with only 37% of participants expecting the same difficulties for 2024. These sentiments are currently borne out by BLS data with hiring rates not keeping up with job openings at present, indicating that employers are not able to hire all the employees that they would like.

According to the 2023 Nonprofit HR Talent Management Priorities Survey Results, 66% of organizations responded saying they were prioritizing total rewards in 2023. The survey also showed that 40% were focused on benchmarking existing total rewards practices and programs.

LEADERSHIP CONSIDERATIONS

Focus on Cost of Labor

Nonprofit HR continues to urge employers to focus on cost of labor and not cost of living. The cost of living is the market value of goods, such as housing, food and fuel. The cost of labor is how expensive it is to hire people in an area and not how expensive it is to live in that area. There is no correlation between the two measures. As mentioned before, the cost of labor has historically outpaced the cost of living. Inflation is already trending back toward what might be considered “normal” levels given historic rates over the past decade with the average employee’s paycheck stretching a bit further than it has over the past year.

Any lingering concerns over employees’ purchasing power and inflation should be addressed through short-term measures and not permanent ones. Implementing more measured strategies here can avoid cascading effects, including raising the cost of variable pay and benefits. If employers want to implement something during times of inflation, it is recommended to make payments based on employee level, salary and location. These payments are not added to base salary to avoid escalating costs over time. These types of payments may be one-time or refreshed on some other cadence, e.g. quarterly, semi-annually or annually.

Salary Increase Budget

While the market is stabilizing, there are still many indicators that the labor market continues to be tight, and employers may need the flexibility to address talent attraction and retention challenges. It is not expected that the economy will shift enough before the end of the year that the pre-pandemic trend of an approximate 3% increase will suffice. Nonprofit HR recommends planning for a salary increase budget of 4% to 4.5%.

A larger budget for salary increases alone is not enough to address attraction and retention challenges, even if most employers are expecting to reduce their budgets from what was spent in 2022. Employers should continue to evaluate non-monetary actions to attract and retain talent, including increasing workplace flexibility, placing a broader emphasis on diversity, equity, and inclusion efforts, and making changes to improve the overall employee experience.

Ongoing Attention to Compensation Strategy

Employers should monitor their compensation strategy more frequently as the market continues to shift and as needs change. While the market is righting itself toward more normal expectations, the uncertainties over the past couple of years have hampered employers’ ability to accurately plan, requiring employers to be more agile in their approach to compensation and to not just wait to act once a year with a focal-point review.

Education and Communication

Employers should continue to keep up education efforts around basic economics and labor markets. Employees can look up just about anything online, including “real-time” data, and believe that the organization’s pay policies and practices are not keeping up with the market. Again, even with things appearing to return to normal, aiding and educating employees in financial literacy is an important part of every organization’s compensation program that will go a long way in instilling confidence in pay decisions and an organization’s market position to be able to attract and retain talent.

Frequency of Refreshing Market Data

The volatility of the labor market over the past two years has made estimating the cost of labor shifts more challenging. While the market is stabilizing, the effects of the volatility are still being felt by organizations and Nonprofit HR continues to recommend that organizations’ market ranges be reviewed more frequently, no less than every two years, to account for new trends in the labor market. Previous guidance given to clients and a good general rule have been to review market ranges or compensation structures at least every three years. However, employers’ responses to the pandemic and subsequent inflation have introduced more factors than were previously considered in setting pay.

Employers may be tempted to simply apply a percentage increase to their current compensation model. However, this is not strictly recommended, since a percentage increase to the ranges of a compensation structure does not necessarily reflect the shift in the cost of labor within the market. That figure may be used as a quick way to estimate what the overall cost of labor might be. However, overall market value is more complex, and the reality is that some jobs may decrease in market value while others increase at rates that far surpass budget planning figures.

Participate in Salary Surveys

Finally, Nonprofit HR always recommends that organizations participate in multiple salary surveys relevant to the nature of their missions and status as a nonprofit. While this can be a time-consuming process, particularly for the first time with a new vendor, completing this step can offer a valuable contribution to the sector. Participation in this process helps to ensure that surveys have the broadest range of data available to accurately report on the market worth of the jobs that they examine, and thus strengthens the common understanding of the market and the range of pay practices implemented by survey respondents within their respective organizations.

Are you seeking support for your organization’s Total Rewards program?

With Nonprofit HR as your partner, you can fully engage, empower and sustain your people through a holistic Total Rewards approach that fully aligns with your organization’s people management priorities, strategic plan and shared values.